Marler Haley have released sale and Black Friday statistics for search trends in the UK, detailing the rise in mobile searches and the implications for retailers – both B2C and B2B.

Although seen as a short-lived trend by many marketers, there is a four times greater search volume for Black Friday related search terms as compared to generic ‘sale’ terms proving its growing importance for retailers.

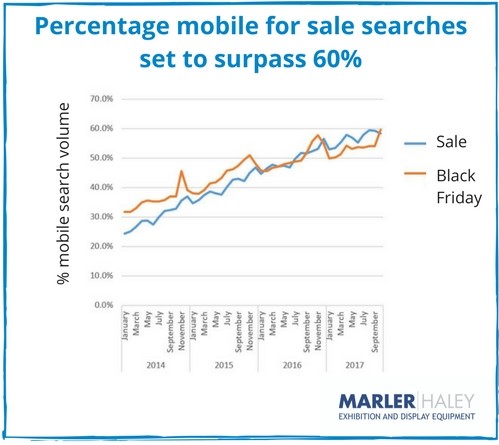

For peak UK sale related searches in November and December 2017, the use of mobile to conduct these searches will surpass 60%, showing how important a mobile-first strategy is for retailers.

However, the study also suggests that a mobile-first approach isn’t as vital for some B2B retailers, where mobile search trends vary between 10-30% and show a much slower growth.

The study compiles data from Google’s keyword planner to find average search volume for related searches in the UK for desktop and mobile devices. Marler Haley, who compiled the research are a leading supplier of

pop up banners and

exhibition stands in the UK.

Black Friday search statistics in the UK 4x greater than sale searches

UK sale search volumes suggest an increase in consumers seeking out a bargain year on year – especially in the Christmas sales, with minor peaks in June/July.

- In 2016, annual search volume for sale related searches grew by 77%

- Sale related searches spike in the pre- and post-Christmas sales in December.

- Most people search for sale terms in December, with a 300 times greater search volume as compared to other months.

Black Friday is a relatively new concept for UK retailers, which began to boom with an exponential growth in search traffic in 2014.

- Black Friday has a 4 times greater search volume annually than sale related terms.

- Over 7 million Black Friday searches are performed in November in the UK.

- 2016 had the highest search volume to date in the UK for Black Friday, which was an increase of 11% as compared to 2015.

IMRG sources state that the total spend on online retail sites on Black Friday 2016 was £1.23bn, making a +12.2% increase on the £1.1bn spent on the same day in 2015, which is on par with the level of growth in search volume that we have found.

So even if Black Friday is seen as an American trend, it’s definitely one that consumers are seeking out.

Mobile first for consumer searches

Understanding how people are searching for retail products is important for businesses. It helps to provide the right visitor experience – and of course helps to convert visitors into sales.

- StatCounter suggested that the shift in percentage mobile versus desktop happened globally in October 2016.

- A more recent study by Stone Temple Consulting earlier this year suggested that 55% of all traffic is now coming from a mobile device.

This shift in uptake has led Google to discuss a shift to a

mobile first index and rank websites based on the content of your mobile experience.

- We identified the percentage of mobile searches for Sale and Black Friday searches will surpass 60% by the end of 2017, which builds on previous findings and strengthens a mobile-first approach for B2C retailers.

Mobile is not first for B2B retailers

Although consumer web interaction is showing a steady trend toward a mobile first approach, the same cannot be said for B2B websites.

To investigate, we reviewed search traffic against mobile search traffic for some of the largest B2C eCommerce businesses – Argos, Asos and Tesco against 3 B2B eCommerce businesses – Marler Haley, RS Components and Viking Direct.

These businesses were chosen as the brand searches contain related branded searches rather than ambiguous searches – for example, people searching for the Amazon rain forest.

- The shift to mobile-first happened much earlier for large retailers such as Argos, who have already reached a 60% mobile search volume in October 2017.

- B2C brand searches are between 50-60% mobile, suggesting that this still fluctuates heavily depending on the business.

- B2B retailers have half the percentage mobile searches as compared to B2C.

- B2B retail searches vary from 10% to 30% mobile, suggesting that mobile is still second to desktop.

Importance of these findings for retailers

Gemma Russo, Head of eCommerce at Marler Haley said:

“With the growth of mobile for consumer related search terms, marketing managers are feeling increasingly pressured to make sure that they have a mobile first strategy when it comes to web-design and conversion optimisation.

“The rise in mobile has largely been documented in B2Cs, with B2B eCommerce websites being seemingly forgotten when intuitively, you’d expect to see a much lower level of growth in mobile.

“Our study suggests that there really is a much lower level of growth for B2B mobile.

“As such, it’s often seen as a much lower priority as it’s likely to have a lesser impact for B2Bs than B2Cs. Although it’s sensible for new websites to be built with a mobile-first approach as a matter of course, it’s more likely to be added as future proofing rather than an immediate need based on user experience.

“Our findings highlight the importance of understanding your own users for the growth in mobile, to understand your competitors’ adoption of mobile-first and knowing whether that’s normal for your industry.” Methods:

- Data was compiled using Google Adwords to find UK search volume for search terms and related search terms.

- Marler Haley’s mobile search trends were taken from Google Analytics organic data

For a data pack please contact

marketing@marlerhaley.co.uk